Quote Funnel Matches

SuperMoney currently provides loan pre-qualification offer engines for various loan verticals. Consumers can get real-time pre-qualified loan offers from multiple lending partners at once, providing a valuable comparison shopping experience. Pre-qualified offers have discrete APRs, loan terms, and loan amounts tied to them.

Loan offer engines are offered in these verticals currently personal loans, auto purchase loans, auto loan refinancing, business loans, and student loan refinancing.

Product Background

The Problem

Hotjar data reveals that many users are overlooking the debt and tax suggestions presented at the end of the process.

The Assumption

This may have to do with the fact that both tax and debt opt-in suggestions are located at the end, when the user is about to submit for personal loans.

The Requirement

The new TCPA rules mandate lead generators to obtain consumer consent for each seller that may reach out out to them.

The Goal

We need to find a solution that allows us to determine if a user is pre-qualified for these additional products without requiring them to actively opt in.

The Team

The team consisted of 1 Product Designer, The CEO, and 1 Engineer to get this project implemented and launched.

As the Product Designer, my role was to gather the requirements and draft wireframes and mockups that solve the problem. I presented the solutions to the team, and worked on iterations.

After a design was chosen, I worked closely with the engineer to answer his questions about the UX and to set up the A/B test to see which version performed better,

User Persona

The user currently has to opt-in separately for tax and debt relief if they marked down that they have unsecured and tax debt.

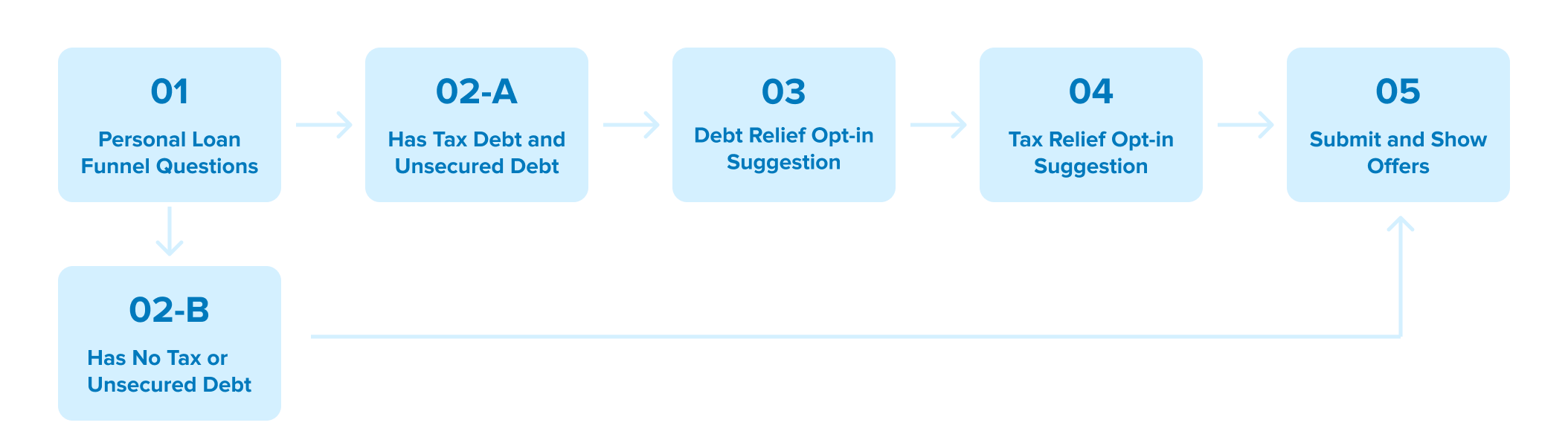

Current User Flow

Proposed User Flow

The user will be given a list of products that they matched with where they can choose to opt in or out of specific products. If the user has opt-out at steps 3 and 4, they still have the opportunity to opt back in at step 5 and be able to see all the lenders they matched with.

Wireframes

PROS: Cleaner UI, ability to see more details about each lender

CONS: List is more hidden, more clicks for the user

Variation A - Lightbox

PROS: Less clicks to opt in or out and to see the lenders list.

CONS: Too many logos displayed on the page and not enough information about the lenders.

Variation B - Dropdown

Design Mockups

Variation A - Lightbox

Variation B - Dropdown

A/B Testing

Hypothesis:

In our A/B testing in tax relief we found that being transparent about the matches did actually improve conversion rates. So we believe the dropdown will perform better since it is more upfront to the users, rather than hidden in a link to open the lightbox.

Control

VAR A - Lightbox

Variable

VAR B - Dropdown

Duration

2 weeks

Metric Measured

Dropoff Rate

Results:

Overall, these two performed pretty much the same with a slight difference depending on the day. We chose to move forward with VAR B in support of better transparency for the users.

Outcome & Key Learnings

After implementing the VAR B dropdown design, we saw that the dropoff rates have improved significantly — almost twice the amount. After the first month of implementation, the dropoff rate went from 3.12% to 1.85%.

Performance

Our lending partners were also pleased with the changes since we found that more customer leads were being submitted to them, which also increases our revenue from our partnership agreement.

Stakeholders

One small change to the user experience can make a huge impact. Despite biases, we should look and trust in the data to make informed decisions.

Reflection

Curious to know more?

Schedule a call with me!

joann.mae.lau@gmail.com